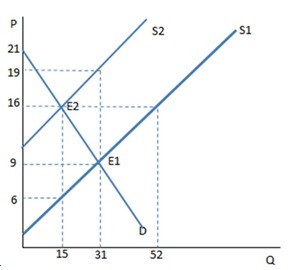

The graph shown demonstrates a tax on sellers. Which of the following can be said about the effect of this tax?

The graph shown demonstrates a tax on sellers. Which of the following can be said about the effect of this tax?

A. The tax creates a shortage, and rationing must occur.

B. The tax creates a shortage, and the government must regulate the market.

C. The tax creates a surplus, and the government must buy the excess.

D. None of these is true.

Answer: D

You might also like to view...

Members of the Federal Reserve Board of Governors are

A. appointed by Congress to staggered 14-year terms. B. selected by each of the Federal Reserve banks for 4-year terms. C. selected by the Federal Open Market Committee for 4-year terms. D. appointed by the president to staggered 14-year terms.

Why does each of these gas stations have so little control over the price of the gasoline they sell?

What will be an ideal response?

The Santa Fe Spark Plug Company supplies spark plugs to automotive parts dealers. An increase in the demand for its product led Santa Fe to hire 150 new workers

Santa Fe also plans to expand the capacity of its plant but this project will take 2 years to complete. Which of the following statements is true? A) The long run for Santa Fe is longer than 1 year. B) The wages and benefits paid to the new workers are implicit costs. C) In the short run Santa Fe's variable costs increase but its fixed costs decrease. D) The short run for Santa Fe is 1 year.

If the MPS is 0.1 and the income tax rate is 0.33 the marginal leakage rate for a closed economy is

A) 0.033. B) 0.23. C) 0.43. D) 0.397.