Bank C promises to pay a compound annual interest rate of 6 percent, while Bank S pays a 10 percent simple annual interest rate on deposits. If you deposit $1,000 in each bank, after 10 years, your deposit in Bank C equals ________, while your deposit in Bank S equals ________.

A. $1,791; $2,000

B. $1,600; $2,594

C. $1,600; $2,000

D. $1,060; $1,100

Answer: A

You might also like to view...

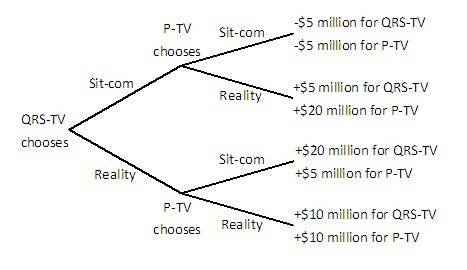

P-TV and QRS-TV are trying to decide whether to air a sitcom or a reality show in a given time slot. Viewers like both sitcoms and reality shows, but sitcoms are more expensive to produce than reality shows since real actors need to be hired. QRS-TV makes its decision first, and then P-TV observes that choice before making its decision. Both stations know all of the information in the decision tree below.  Given the information in this decision tree, if QRS-TV announces that it will air a reality show, it can expect to:

Given the information in this decision tree, if QRS-TV announces that it will air a reality show, it can expect to:

A. lose $5 million. B. earn $20 million. C. earn $5 million. D. earn $10 million.

In the figure above, what is the loss of consumer surplus if the firm is a perfectly price-discriminating monopoly instead of a perfectly competitive industry?

A) $0 B) $22.50 C) $45.00 D) $90.00

The long run equilibrium level of real output increases whenever: a. AD increases

b. SRAS increases. c. LRAS increases. d. Any of the above occurs.

How would an increase in the required reserve ratio affect banks' ability to create money?

a. Banks will be able to create more money because of the decrease in excess reserves. b. Banks will be able to create more money because of the increase in the demand deposit multiplier. c. It will have no effect on banks' ability to create money. d. It will reduce banks' ability to create money by forcing them to hold more reserves. e. It will reduce the banks' ability to create money by increasing excess reserves.