In calculating cash flows from operating activities using the indirect method, an increase in inventories is:

a. added to net income.

b. deducted from net income.

c. ignored because it does not affect cash.

d. not reported on a statement of cash flows.

Ans: b. deducted from net income.

You might also like to view...

A line chart is a chart that connects a series of data points using continuous lines

Indicate whether the statement is true or false

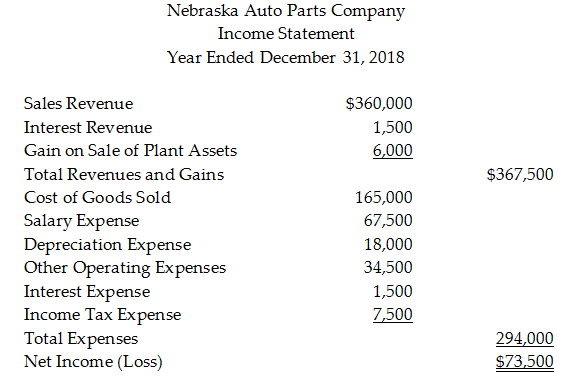

Prepare the operating activities section of the statement of cash flows.

Nebraska Auto Parts Company uses the indirect method to prepare the statement of cash flows. Refer to the following income statement:

Additional information provided by the company includes the following:

Current assets other than cash increase by $36,000.

Current liabilities decrease by $1,500.

Eban Corporation uses the FIFO method in its process costing system. The first processing department, the Welding Department, started the month with 18,000 units in its beginning work in process inventory that were 50% complete with respect to conversion costs. The conversion cost in this beginning work in process inventory was $52,200. An additional 55,000 units were started into production during the month. There were 16,000 units in the ending work in process inventory of the Welding Department that were 20% complete with respect to conversion costs. A total of $284,160 in conversion costs were incurred in the department during the month.The cost per equivalent unit for conversion costs is closest to:

A. $5.550 B. $4.608 C. $5.167 D. $5.800

A firm is trying to determine if it should launch a product. The product has an expected life of three years. It will bring in cash flows of $10,000 in the first year, $11,000 in the second year, and $8,000 in the third year. The company estimates that it will invest $20,000 in product research and development costs. What is the estimated IRR for this product? Choose the IRR value that is closest to the amount invested.

a. 12% b. 22% c. 32% d. 42%