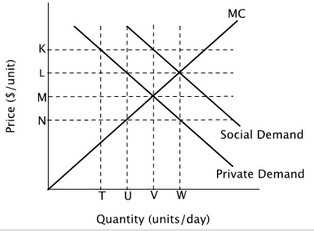

Refer to the figure below. The socially optimal quantity in this market could be achieved by imposing a ________ equal to the vertical distance ________.

A. tax; LM

B. subsidy; LM

C. tax; LN

D. subsidy; LN

Answer: B

You might also like to view...

With no Ricardo-Barro effect, a government budget surplus

A) decreases the demand for loanable funds and increases the real interest rate. B) increases the demand for loanable funds and lowers the real interest rate. C) increases the supply of loanable funds and lowers the real interest rate. D) increases the demand for loanable funds and raises the real interest rate. E) decreases the supply of loanable funds and lowers the real interest rate.

Other things remaining the same, if a nation's expected price level rises, the demand to hold money:

a. Falls. b. Rises. c. Does not change.

Environmental policies like corporate average fuel economy (CAFE) standards and mandatory technology like catalytic converters _____________________ fuel consumption and emissions without necessarily _________________ the number of automobiles sold.

a. increase; reducing b. increase; increasing c. reduce; reducing d. reduce; increasing e. None of the above.

The U.S. imposes substantial taxes on cigarettes but not on loose tobacco. When the tax on cigarettes went into effect, the demand for home cigarette rolling machines most likely:

A. increased, causing the price of cigarette rolling machines to rise and the quantity of machines purchased to rise. B. increased, causing the price of cigarette rolling machines to rise and the quantity of machines purchased to fall. C. decreased, causing the price of cigarette rolling machines to fall and the quantity of machines purchased to fall. D. decreased, causing the price of cigarette rolling machines to rise and the quantity of machines purchased to fall.