Should state taxes paid be deductible on federal taxes?

What will be an ideal response?

Opinions vary on this issue. Some argue that this "offset" allows for states to pass on higher

rates to other states through the federal system. Others argue that there are too many layers

of taxes currently and this deduction is necessary to keep taxes reasonable.

You might also like to view...

Where a firm generates beneficial externalities, society would be better off if

A. the firm produced a larger output level. B. the firm reduced its output level. C. a tax was levied on the firm equal to the dollar amount of the externalities. D. price was reduced below marginal private cost.

When demand is written as log(Q) = -0.23 - 0.34 log(P) + 1.33 log(I), the price elasticity of demand equals:

0.72 -0.23 -0.34 1.33

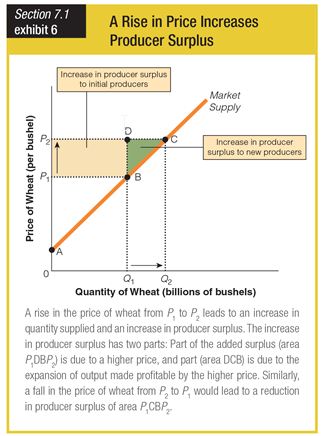

Look at this producer surplus graph. Suppose that Herb is a wheat farmer who grows only a small crop because he cannot make much profit at P1. When the price moves to P2, what is Herb most likely to do?

a. Begin planting an even smaller crop.

b. Begin planting a larger crop.

c. Quit growing wheat completely.

d. Wait to sell his wheat until the price returns to P1.

A human resource such as ingenuity can be thought of as

A. a causal factor for aggregate supply shifting left. B. part of a country's endowment. C. the outcome of more investment spending. D. part of government spending programs.