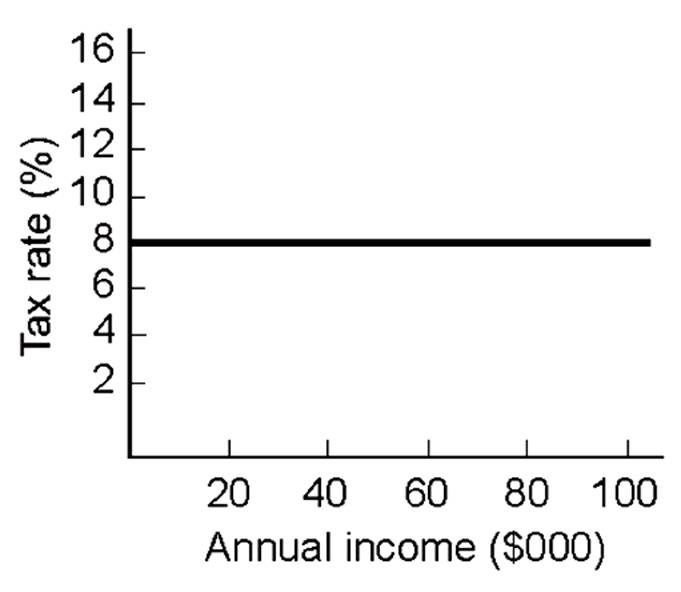

The tax shown in the graph above is

A. nominally progressive and regressive in effect.

B. nominally progressive and progressive in effect.

C. nominally proportional and progressive in effect.

D. nominally proportional and regressive in effect.

D. nominally proportional and regressive in effect.

You might also like to view...

GDP consistently measures the output of goods and services in all countries.

Answer the following statement true (T) or false (F)

An increase in the real risk-free interest rate causes the:

a. Preferred asset ratio for currency in circulation (C/D) to fall, which increases the quantity of real loanable funds supplied. b. Preferred asset ratio for customary reserves (U/D) to rise, which increases the quantity of real loanable funds supplied. c. Preferred asset ratio for near money (N/D) to fall, which increases the quantity of real loanable funds supplied. e. None of the above.

What is the difference between revenue and cost?

A. Input B. Production C. Output D. Profit

Calculate GDP for an economy with exports of $5 trillion, investment of $1.5 trillion, consumption spending of $11 trillion, imports of $6 trillion, and government purchases of $3 trillion