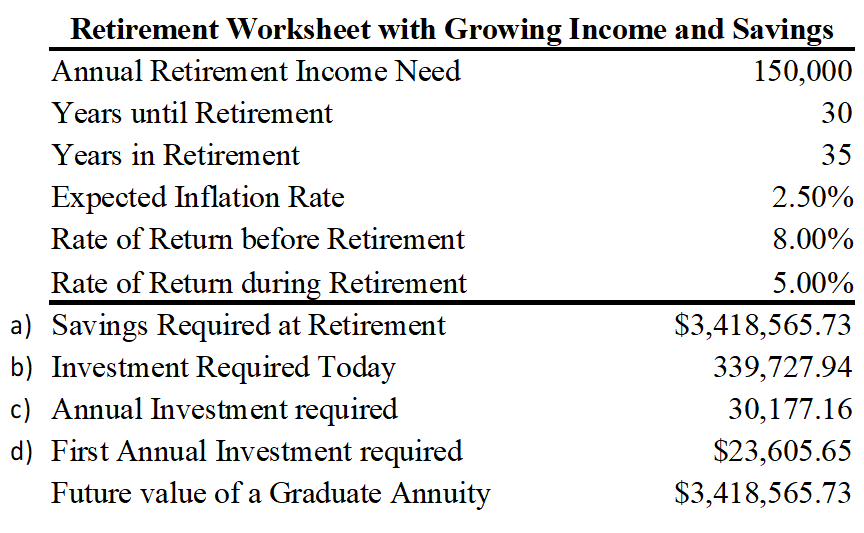

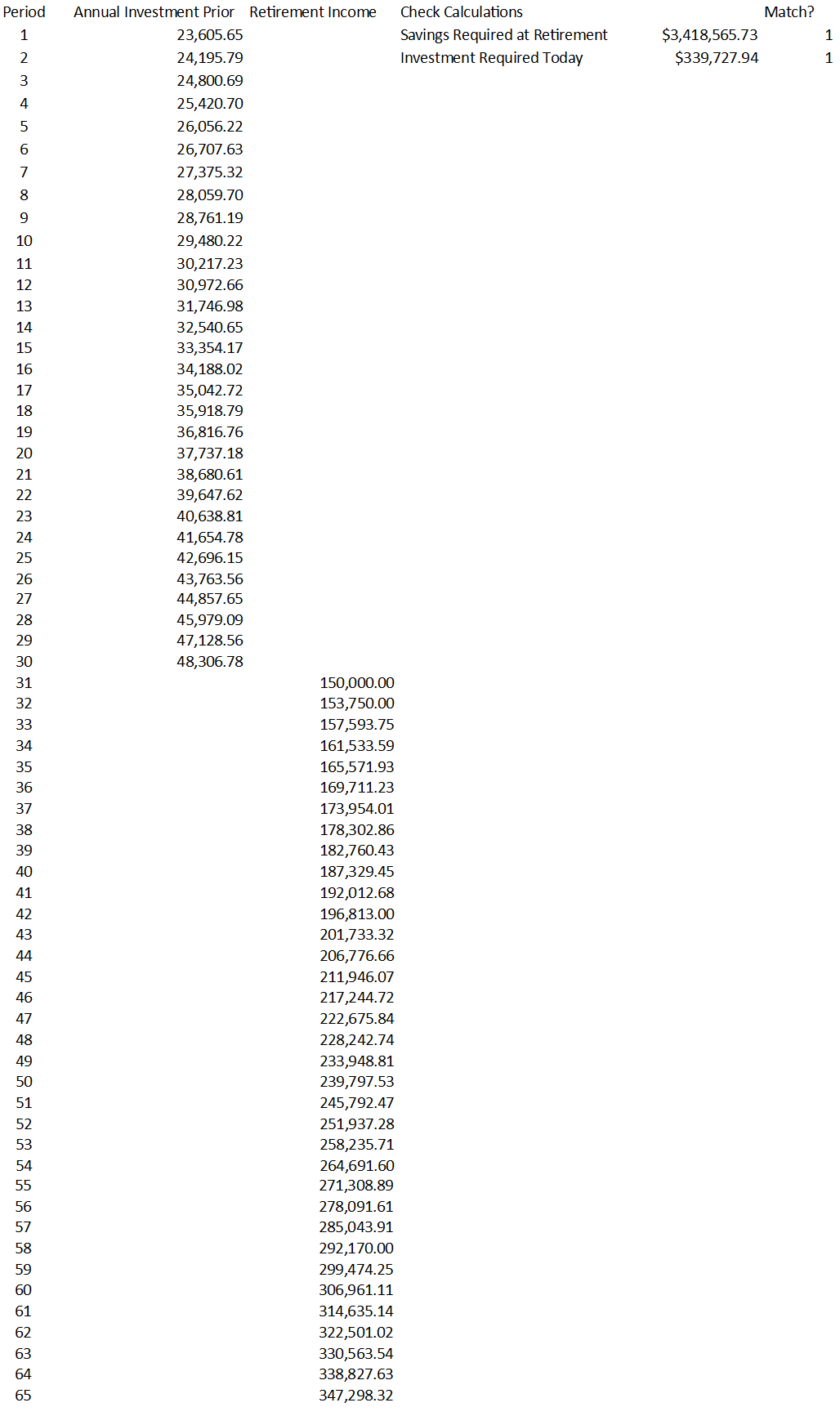

Using the information below, answer the following questions:

a) Using equation 8-10 from the book, how much money will you need to have accumulated at the time of retirement to be able to meet your income needs during retirement?

b) If you were to make a single lump sum investment today, how much would you need to invest annually to meet your goal at the time of retirement?

c) If you were to invest an equal dollar amount each year, how much would you need to invest annually to meet your goal at the time of retirement?

d) Assume that your employer will raise your annual wage every year by at least the rate of inflation so that your retirement savings can also increase proportionally. Use equation 8-14 to determine the first required annual investment.

e) To illustrate the importance of the return on your investment, set up a scenario analysis that shows your investment required today, the annual investment required, and the first annual investment required considering savings as graduate annuities. Assume four scenarios where your rate of return before retirement is 5%, 7%, 10%, and 15%. How likely do you think it is that you will be able to earn 10% or 15% per year on your investments? What do these results suggest to you about the importance of financial literacy?

You might also like to view...

What is referred to as loss aversion?

What will be an ideal response?

Which of the following is NOT an underlying trait of character of an effective leader identified by Johnson?

A. Reverence B. Temperance C. Confidence D. Compassion

Oregon State University has reached the final four in the NCAA Women's Basketball Tournament, and as a result, a sweatshirt supplier in Corvallis is trying to decide how many sweatshirts to print for the upcoming championships. The final four teams (Oregon State, University of Washington, Syracuse, and University of Connecticut) have emerged from the quarterfinal round, and there is a week left until the semifinals, which are then followed in a couple of days by the finals. Each sweatshirt costs $12 to produce and sells for $24. However, in three weeks, any leftover sweatshirts will be put on sale for half price, $12. The supplier assumes that the demand (in thousands) for his sweatshirts during the next three weeks, when interest is at its highest, follows the probability distribution

shown in the table below. The residual demand, after the sweatshirts have been put on sale, also has the probability distribution shown in the table below. The supplier realizes that every sweatshirt sold, even at the sale price, yields a profit. However, he also realizes that any sweatshirts produced but not sold must be thrown away, resulting in a $12 loss per sweatshirt. ? Demand distribution at regular price Demand distribution at reduced price ? Demand Probability Demand Probability 7 0.05 2 0.20 8 0.10 3 0.30 9 0.25 4 0.20 10 0.30 5 0.15 11 0.20 6 0.10 12 0.10 7 0.05 Use simulation to analyze the supplier's problem. Determine how many sweatshirts he should produce to maximize the expected profit. What will be an ideal response?

One way of keeping a trade secret is to obtain a patent on it

Indicate whether the statement is true or false