A tax whose burden, expressed as a percentage of income, falls as income increases is a

A. progressive tax.

B. benefits-received tax.

C. regressive tax.

D. proportional tax.

Answer: C

You might also like to view...

Marginal utility diminishes as consumption of a good decreases

Indicate whether the statement is true or false

Consider a medical breakthrough that led to the discovery of a simple microchip, which when inserted inside the human ear could prevent certain chronic diseases. The price elasticity of demand for that microchip would most likely be _____

a. highly elastic b. highly inelastic c. undefined d. negative only for high prices e. positive only for high prices

Generally, expenses on toothpaste are a small part of a consumer's budget, so the demand for toothpaste is more likely to be

A. elastic. B. perfectly elastic. C. unit elastic. D. inelastic.

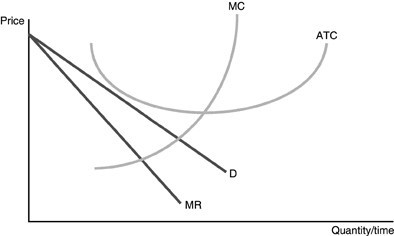

Refer to the above figure. Profits for this firm are

Refer to the above figure. Profits for this firm are

A. negative. B. zero. C. positive. D. undetermined without more information.