Assume you borrow $1,000 on credit cards at an annual interest rate of 10 percent. If the inflation rate is 12 percent during the year and the debt has to be paid back in 12 months, then:

a. income will be redistributed from you to the bank.

b. the real return for the bank will be greater than initially expected.

c. you will repay the bank with fewer dollars than you borrowed.

d. the dollars repaid will have less purchasing power than those borrowed.

e. the bank will obtain the same return on the loan as initially expected.

d

You might also like to view...

Describe the main problem with rate of return regulation and name an alternative regulatory scheme that has been devised to deal with that problem

What will be an ideal response?

If two goods are complementary, the cross elasticity will be negative

Indicate whether the statement is true or false

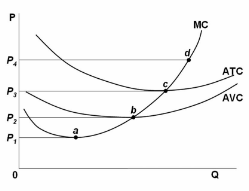

Refer to the diagram for a purely competitive producer. If product price is P 3 :

A. the firm will maximize profit at point d.

B. the firm will earn an economic profit.

C. economic profits will be zero.

D. new firms will enter this industry.

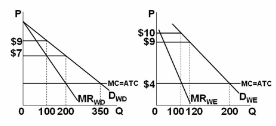

Refer to the figure. Suppose the graphs represent the demand for use of a local golf course for which there is no significant competition (it has a local monopoly); P denotes the price of a round of golf; Q is the quantity of rounds "sold" each day. If the left graph represents the demand during weekdays and the right graph the weekend demand, then over the course of a full seven-day week this price-discriminating, profit-maximizing golf course should sell a total of:

A. 300 rounds.

B. 740 rounds.

C. 900 rounds.

D. 1,200 rounds.