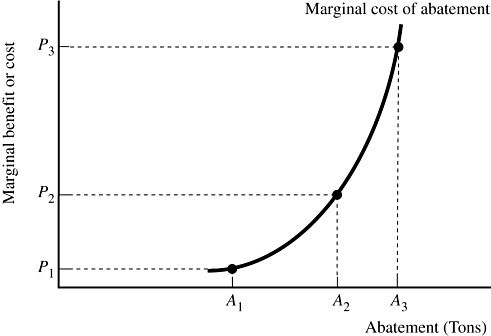

A firm that generates pollution is illustrated in Figure 9.7. If the government imposes a pollution tax equal to P1, the marginal benefit to the firm of abating A2 is:

A firm that generates pollution is illustrated in Figure 9.7. If the government imposes a pollution tax equal to P1, the marginal benefit to the firm of abating A2 is:

A. P1.

B. P2.

C. P1 - P2.

D. P2 - P3.

Answer: A

You might also like to view...

Which markets are depicted in the basic circular flow model?

A) the factor market and the bond market B) the stock market and the bond market C) the money market and the foreign exchange market D) the goods market and the stock market E) the goods market and the factor market

Double taxation of corporate earnings

A. is an advantage that other business organizations do not enjoy. B. implies that stockholders earn higher returns to offset the tax disadvantage compared to other, similar financial assets. C. reduces the limited liability of corporations. D. only exists when corporations suffer losses.

In the short run, all costs are fixed

a. True b. False

Which product is most likely to be most price elastic?

A. Clothing B. Automobiles C. Gasoline D. Milk