Jack paid $5,000 in daycare expenses for his five-year-old daughter so he could work. His AGI for the year was $37,500 (all earned income). What is the amount of his child and dependent care credit?

What will be an ideal response?

$690.

Answer computed as follows:

| Description | Amount | Explanation | |||

| (1) | Dependent care expenditures | $ | 5,000 | ||

| (2) | Limit on qualifying expenditures for one dependent | 3,000 | |||

| (3) | Jack's earned income | 37,500 | |||

| (4) | Expenditures eligible for credit | $ | 3,000 | Least of (1), (2), and (3) | |

| (5) | Credit percentage rate | 23 | % | AGI between $37,000 and $39,000 | |

| Dependent care credit | $ | 690 | (4) × (5) | ||

You might also like to view...

In its first year of business, Borden Corporation had sales of $2,200,000 and cost of goods sold of $1,300,000. Borden expects returns in the following year to equal 6% of sales. The adjusting entry or entries to record the expected sales returns is (are):

A.

| Sales Refund Payable | 132,000? | |

| Accounts receivable | 132,000? |

B.

| Sales Returns and Allowances | 132,000? | |

| Sales Refund Payable | 132,000? | |

| Inventory Returns Estimated | 78,000? | |

| Cost of goods sold | 78,000? |

C.

| Accounts Receivable | 2,200,000? | |

| Sales | 2,200,000? |

D.

| Sales | 2,200,000? | |

| Sales Refund Payable | 132,000? | |

| Accounts receivable | 2,068,000? |

E.

| Sales returns and allowances | 132,000? | |

| Sales | 132,000? | |

| Cost of Goods Sold | 78,000? | |

| Inventory Returns Estimated | 78,000? |

Elison Corporation, which has only one product, has provided the following data concerning its most recent month of operations: Selling price$111 Units in beginning inventory 0Units produced 7,500Units sold 7,200Units in ending inventory 300 Variable costs per unit: Direct materials$24Direct labor$34Variable manufacturing overhead$1Variable selling and administrative expense$5Fixed costs: Fixed manufacturing overhead$217,500Fixed selling and administrative expense$115,200What is the net operating income for the month under variable costing?

A. $5,700 B. $14,400 C. $(12,000) D. $8,700

The probability of A, given B, must be at least as large as the probability of the intersection of A and B

Indicate whether the statement is true or false

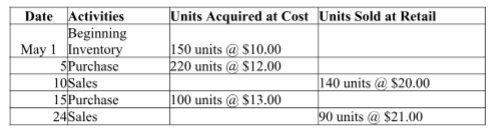

Salmone Company reported the following purchases and sales of its only product. Salmone uses a perpetual inventory system. Determine the cost assigned to ending inventory using LIFO.

A) $5,440

B) $2,460

C) $2,590

D) $2,980

E) $2,860