Which of the following might break the link in the Keynesian transmission mechanism between the expansionary monetary policy and the goods-and-services market?

A) a downward-sloping investment demand curve

B) a vertical money supply curve

C) a belief on the part of individuals that bond prices are extraordinarily low

D) all of the above

E) none of the above

E

You might also like to view...

A market demand curve can be constructed by

A) adding the prices all consumers will pay for any given quantity. B) adding the quantities that all consumers buy at each price. C) adding the quantities that a consumer buys at the highest price. D) None of the above answers is correct.

Tom takes 20 minutes to cook an egg and 5 minutes to make a sandwich. Jerry takes 15 minutes to cook an egg and 3 minutes to make a sandwich. If Tom and Jerry trade

A) Tom will benefit and Jerry will not. B) Jerry will benefit and Tom will not. C) both will benefit. D) none of them will benefit.

The present value of a promise to pay $100 one year from now would be greater if the interest rate were higher

a. True b. False

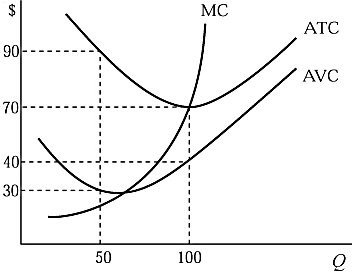

Figure 5.4 shows a firm's marginal cost, average total cost, and average variable cost curves. The average total cost curve is downward-sloping as output increases from Q = 50 to Q = 100 because:

Figure 5.4 shows a firm's marginal cost, average total cost, and average variable cost curves. The average total cost curve is downward-sloping as output increases from Q = 50 to Q = 100 because:

A. increasing average variable cost outweighs decreasing average fixed cost. B. decreasing average fixed cost outweighs increasing average variable cost. C. diminishing returns are not severe enough to outweigh decreasing average fixed cost. D. marginal cost is increasing.