John's uncle donated a truck to his company, John's Corporation. The truck had an original cost of $95,000, a book value of $40,000, and a fair value of $60,000. The journal entry by John's Corporation to record this donated asset will include a

A) ?debit Truck for $60,000 and credit Gain for $20,000.

B) ?debit Truck for $60,000 and credit Gain for $60,000.

C) ?debit Truck for $95,000 and credit Gain for $35,000.

D) ?debit Truck for $95,000 and credit Gain for $95,000.

B

You might also like to view...

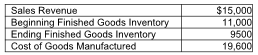

Compute cost of goods sold.

Franklin Manufacturing provided the following information for the month ended March 31:

A) $19,600

B) $18,100

C) $21,100

D) $29,100

Wichita Industries' sales are 10% for cash and 90% on credit. Credit sales are collected as follows: 30% in the month of sale, 50% in the next month, and 20% in the second following month. Wichita Industries' had $12,000 from November sales and $42,000 from December sales. Assume that total sales for January and February are budgeted to be $50,000 and $100,000, respectively. What are the expected cash receipts for February from current and past sales?

A. $80,500. B. $71,500. C. $61,500. D. $59,500. E. $34,500.

“The entire purchasing process or cycle” refers to the concept of _______.

a. sourcing b. supply management c. purchasing d. procurement

Suppose you have $30,000 invested in the stock market and your banker comes to you and tries to get you to move that money into the bank's certificates of deposit (CDs). He explains that the CDs are 100 percent government insured and that you are taking unnecessary risks by being in the stock market. How would you respond?

What will be an ideal response?