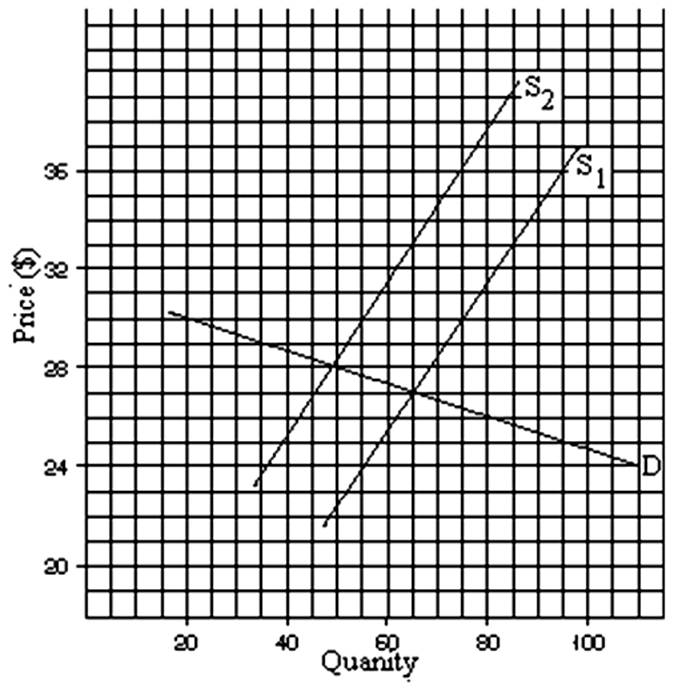

A. How much is the tax in the above graph? B. How much of this tax is borne by the buyer and how much is borne by the seller? C. As a result of the tax, by about how much does consumption fall?

(a) $6

(b) Buyer pays $1 and seller pays $5

(c) about 16

You might also like to view...

How does the production possibilities frontier illustrate production efficiency?

What will be an ideal response?

Which of the following statements is true about the Medicaid program?

a. Eligibility standards are uniform across states. b. The program is totally funded by federal tax revenues. c. Everyone in the poverty-level population is eligible for benefits. d. About 20% of total outlays are for nursing home and home health care for the elderly. e. All of the above are true.

Which of the following countries have experienced recession and high levels of unemployment related to their inability to control the growth of government and high levels of debt?

a. Greece. b. Portugal. c. Italy. d. all of the above.

A firm reaches the minimum efficient scale in the short run.

Answer the following statement true (T) or false (F)