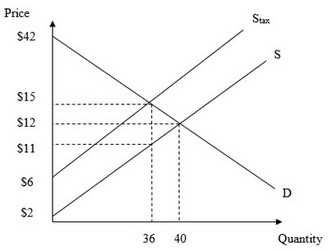

Use the figure below to answer the following question. What is the amount of deadweight loss after the government imposes the excise tax on the market?

What is the amount of deadweight loss after the government imposes the excise tax on the market?

A. $44

B. $8

C. $4

D. $36

Answer: B

You might also like to view...

Private saving increases to some extent when governments run large budget deficits, and private saving falls when governments reduce deficits or run large budget surpluses.

Select whether the statement is true or false. A. True B. False

A useful theory must

A. apply to every conceivable situation. B. be broadly applicable. C. be agreed upon by all economists. D. not be able to be refined.

Assume that for good X the supply curve for a good is a typical, upward-sloping straight line, and the demand curve is a typical downward-sloping straight line. If the good is taxed, and the tax is tripled, the

a. base of the triangle that represents the deadweight loss triples. b. height of the triangle that represents the deadweight loss triples. c. deadweight loss of the tax increases by a factor of nine. d. All of the above are correct.

Logrolling can either increase or diminish economic efficiency.

Indicate whether the statement is true or false.