A business purchases an airplane from an airplane manufacturer. The business obtains a loan to purchase the airplane from a bank, which obtains a security interest in the airplane

The airplane manufacturer is paid for the airplane out of the proceeds of the loan. This is a(n) ________ transaction.

A) two-party secured

B) three-party secured

C) perfected

D) attached

B

You might also like to view...

A company exhibits strategic intent when

A. it aggressively pursues financial objectives, establishing a priority on meeting the performance metrics and instilling a sense of urgency throughout the company. B. management crafts and adopts a strategic plan. C. it capitalizes on its primary competitive advantage and ensures resources are allocated to maintain its strategy. D. it relentlessly pursues an ambitious strategic objective, concentrating the full force of its resources and competitive actions on achieving that objective. E. management establishes a comprehensive set of financial objectives that meet stockholder expectations.

How did the 1916 case of MacPherson v. Buick Motor Co. lead to the elimination of the privity requirement?

What will be an ideal response?

Which of the following is correct with respect to the buyer's obligation of payment?

A) In the absence of agreement, payment is due at the time and place the buyer is to receive the goods. B) Payment by check is sufficient unless the seller demands currency and allows the buyer a reasonable time in which to obtain it. C) If the buyer so agrees, he must pay for the goods in advance of delivery. D) All of these are correct.

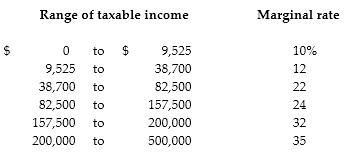

The tax liability of a sole proprietorship with ordinary income of $450,000 is closest to ________.

A) $157,500

B) $133,190

C) $94,500

D) $114,700