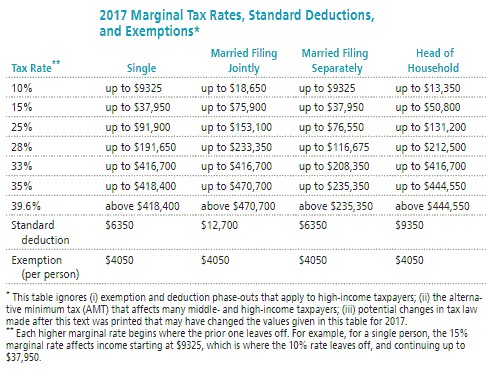

Solve the problem. Refer to the table if necessary. Jenny earned wages of

Jenny earned wages of  received

received  in interest from a savings account, and contributed

in interest from a savings account, and contributed  to a tax deferred retirement plan. She was entitled to a personal exemption of

to a tax deferred retirement plan. She was entitled to a personal exemption of

style="vertical-align: -4.0px;" /> and had deductions totaling  Find her taxable income.

Find her taxable income.

A. $98,530

B. $85,610

C. $80,537

D. $72,437

Answer: D

You might also like to view...

Find the monthly interest payments in the situation described. Assume that monthly interest rates are 1/12 of annual interest rates. Ashton maintains an average balance of  on his credit card which carries an annual interest rate of

on his credit card which carries an annual interest rate of

A. $1500 B. $12.50 C. $125 D. $150

Answer the question.You currently drive 360 miles per week in a car that gets 20 miles per gallon of gas. A new fuel-efficient car costs $12,000 (after trade-in on your current car) and gets 60 miles per gallon. Insurance premiums for the new and old car are $900 and $600 per year, respectively. You anticipate spending $1400 per year on repairs for the old car and having no repairs on the new car. Assuming that gas remains at $3.50 per gallon, estimate the number of years after which the costs of owning the new and old cars are equal.

A. 5.2 years B. 4.7 years C. 3.7 years D. 4.1 years

Solve.Calculate the monthly payment for a home mortgage of  with a fixed APR of 3.0% for 15 years.

with a fixed APR of 3.0% for 15 years.

A. $1313.92 B. $3611.74 C. $35,568.06 D. $4378.47

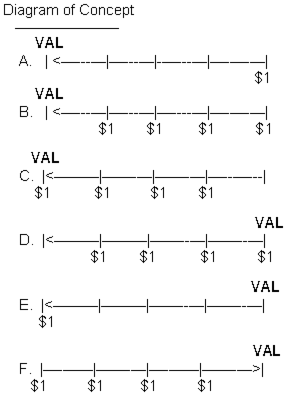

Match the diagrams with the concepts by writing the identifying letter of the diagram on the blank line to the left of the concept. "VAL" represents the value to be calculated.

What will be an ideal response?