If the marginal tax rate is 20%, by how much must income have increased if your tax bill increases by $300?

A. $1,500

B. $300

C. $1,000

D. Cannot be determined

Answer: A

You might also like to view...

Refer to Table 23-2. Using the table above, compute aggregate expenditure and identify the macroeconomic equilibrium

What will be an ideal response?

If the federal government placed a 50 cent per pack excise tax on cigarette manufacturers, and if as a result, the price to consumers of a pack of cigarettes went up by 40 cents, the:

a. actual burden of this tax falls mostly on consumers. b. actual burden of this tax falls mostly on manufacturers. c. actual burden of the tax would be shared equally by producers and consumers. d. tax would clearly be a progressive tax.

Which of the following is a residual reward that accrues to business decision makers who use resources so as to increase their value?

a. opportunity cost b. earnings of employees c. economic profit d. interest earnings of corporate bondholders

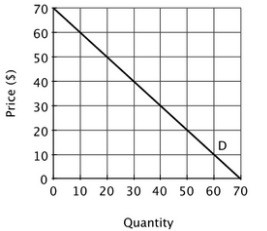

Suppose a monopolist faces the following demand curve. The monopolist maximizes its profits by:

The monopolist maximizes its profits by:

A. producing 35 units, since this is where total revenue is maximized. B. producing the level of output at which marginal revenue equals marginal cost. C. producing the level of output at which marginal revenue minus marginal cost is greatest. D. charging $70 for each unit.