A decrease in the interest rates in a country:

A) increases net exports.

B) does not affect net exports.

C) reduces net exports.

D) results in an inflow of capital to the country.

A

You might also like to view...

When external costs are present and the government imposes a tax equal to the marginal external cost, then

A) efficiency can be achieved. B) transaction costs will be high. C) the marginal benefit of the external cost will fall. D) property rights must have already been established.

The cost of capital is a combination of a firm's payments to the different sources of capital funding is called

A) the weighted average cost of capital. B) the average cost of capital. C) the discount rate. D) the transfer price.

After a loan is made, the:

a. M2 money supply rises until the loan is repaid. b. M2 money supply rises until the loan is spent. c. M2 money supply rises until the loan is cleared. d. M2 money supply does not change until the loan is spent. e. M2 money supply does not change until the loan is cleared.

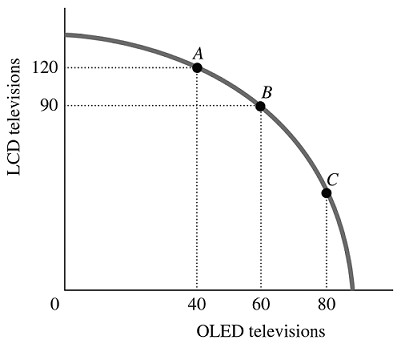

Refer to the information provided in Figure 2.5 below to answer the question(s) that follow. Figure 2.5Refer to Figure 2.5. The marginal rate of transformation in moving from Point A to Point B is

Figure 2.5Refer to Figure 2.5. The marginal rate of transformation in moving from Point A to Point B is

A. -2/3. B. -1.5. C. -3. D. -30.