A Brazilian firm owes you $2,000,000, payable in three months, however, they insist on paying in Brazilian Reals. The current spot exchange rate is $0.59305/Real. The three-month forward exchange rate is $0.61255/Real

How many Real should you demand in a forward contract to receive $2,000,000 in three months to hedge the exchange rate risk?

A) 1,186,100 Real

B) 3,372,397 Real

C) 3,265,040 Real

D) 1,225,100 Real

Answer: C

You might also like to view...

Rocky is an adventuresome, risk-taking person who joins a slow-moving, conservative company. Several months later he leaves in frustration. The career-advancement tactic Rocky neglected was

A) work with a mentor. B) take sensible risks. C) develop depth and breadth. D) find a good organization-person fit.

Realized gains or losses occur when a company adjusts an asset to fair value but has not yet disposed of the asset

Indicate whether the statement is true or false

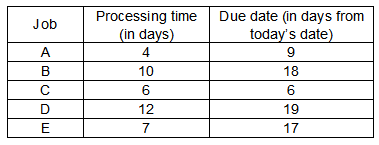

The average tardiness for the jobs listed in the following table under the FCFS (first come, first served) rule is ______.

a. 11 days

b. 9.8 days

c. 15 days

d. 8 days

Describe the two dimensions that help explain the distinction between mergers and acquisitions. Then give a real-life example of one merger and one acquisition.

What will be an ideal response?