Former Fed Chairman Alan Greenspan has argued that low ___________ interest rates, not ______________ interest rates, were the cause of the housing boom in the late 1990s and early 2000s. He also argued that the Fed has more control over _______________ rates than over ____________ rates

A) long-term; short-term

B) long-term; long-term

C) short-term; short-term

D) short-term; long-term

A

You might also like to view...

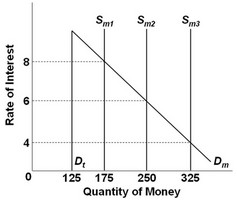

Use the following graph to answer the next question. In the graph, Dt is the transactions demand for money, Dm is the total demand for money, and Sm is the supply of money. The market is in equilibrium at the 6% rate of interest. If the money supply then decreases as shown, the transaction demand for money will change by

In the graph, Dt is the transactions demand for money, Dm is the total demand for money, and Sm is the supply of money. The market is in equilibrium at the 6% rate of interest. If the money supply then decreases as shown, the transaction demand for money will change by

A. $0. B. $75. C. $175. D. $125.

The aggregate expenditure model predicts a business cycle expansion occurs when

A) the aggregate planned expenditure curve shifts downward. B) aggregate supply increases. C) induced expenditure decreases. D) autonomous expenditure increases. E) potential GDP increases.

A rise in the real interest rate

A) shifts the demand for loanable funds curve rightward. B) shifts the demand for loanable funds curve leftward. C) creates a movement upward along the demand for loanable funds curve. D) creates a movement downward along the demand for loanable funds curve.

If an economy experiences deflation, the real interest rate

A) will be greater than the nominal interest rate. B) will be equal to the deflation rate, so long as the nominal interest rate is positive. C) will be negative when the nominal interest rate is positive. D) will be less than the nominal interest rate.