Firms in the market for soccer balls are selling in a purely competitive market. A firm in the soccer ball market has an output of 5,000 balls, which it sells for $10 each. At the output level of 5,000 the average variable cost is $6.00, the average

total cost is $7.50, and the marginal cost is $10.00. What would you expect the firm to do in the short run? The market in the long run?

What will be an ideal response?

This firm is operating at a profit in both the short run and the long run. The firm is operating at the point where marginal revenue equals marginal cost, so output is at its profit maximizing point. Since the marginal revenue of $10 is greater than the average variable cost, $6 the business should remain open in the short run. The average total cost, $7.50, is greater than the marginal revenue implying the firm is making a positive economic profit. It is expected that in the long run firms will enter into the market until marginal revenue falls to the average total cost level.

You might also like to view...

"Lender of last resort" means that the central bank

a. has to lend money to failing banks. b. should lend money to individuals if their bankruptcy would threaten the banking system. c. should lend money to banks that are suffering short-term liquidity shortages. d. should lend money to pay for government deficits. e. None of the above

Whether or not the positive externalities generated by education are inframarginal can be measured with a great degree or certainty

a. True b. False

Unemployment insurance provided by the U.S. government is usually funded by:

a. the excise duties imposed on the import of foreign goods. b. the national tax on payrolls levied on firms. c. external borrowing by the U.S. government. d. printing new money. e. selling off government bonds.

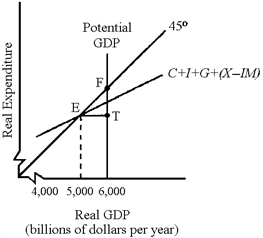

Figure 11-1

In Figure 11-1, to achieve equilibrium at potential GDP the government could

a.

increase taxes.

b.

decrease transfer payments.

c.

increase government purchases.

d.

None of the above is correct.