Taxation lowers social welfare when the taxed good

A. has marginal social costs above marginal private costs.

B. marginal social costs equals marginal private cost.

C. is overproduced under a free-market system.

D. imposes negative externalities .

Answer: B

You might also like to view...

Distinguish the terms price ceiling and price floor.

What will be an ideal response?

Which of the following statements is true?

A. A person who buys a bond always pays the face value for the bond. B. If a corporation issues a bond and Dennis buys it, Dennis becomes one of the owners of the corporation. C. A stockholder of Firm X is one of the owners of Firm X. D. The owner of the bond receives periodic payments equal to its coupon rate times the price he paid for the bond.

An economic model is

a. a plastic scaled version of the economy b. a complete depiction of reality c. an abstraction of reality d. applicable to consumer behavior but not to producer behavior e. not an accepted tool of the economics profession

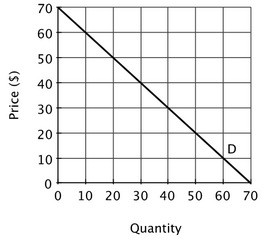

Suppose a monopolist faces the demand curve shown. If the monopolist's marginal cost is constant and equal to $30, its profit-maximizing level of output is:

If the monopolist's marginal cost is constant and equal to $30, its profit-maximizing level of output is:

A. 20 units. B. 30 units. C. 40 units. D. 50 units.