Consider a country with a fixed exchange rate that is experiencing a deficit in its overall payments balance. Show graphically (using IS-LM-FE) and explain how a change in domestic monetary policy could attempt to quickly eliminate the payments deficit. What could be a possible threat to the economy due to the policy change?

What will be an ideal response?

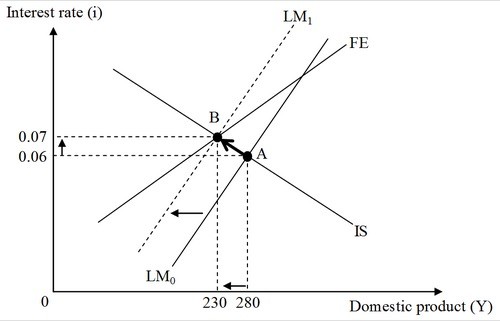

POSSIBLE RESPONSE: The diagram below represents the IS-LM-FE model for a country suffering from deficit in its overall payments balance.

The initial equilibrium of the economy is at Point A. Here, the IS and LM curves intersect each other to the right of the FE curve, denoting the overall payments deficit. The initial interest rate is 0.06 and the domestic product is 280 billion dollars. The government can now address the payments deficit by contracting the money supply. It can sell domestic government bonds in an open market operation. As a result, bank reserves decrease, the money supply contracts, and interest rates rise. The rising interest rate attracts a capital inflow into the country, and the decrease in domestic product and income reduces total imports. The payments deficit shrinks, and external balance is achieved. We can see from the diagram that the LM curve shifts to the left along the IS curve, from LM0 to LM1, and a new triple intersection is achieved at Point B. "i" rises from 0.06 to 0.07 and "Y" decreases from $280 billion to $230 billion.

While applying this policy to achieve external balance, a problem may arise for internal balance. The decrease in the money supply can result in a recession (declining real production), with rising unemployment.

You might also like to view...

It is believed that in order to promote growth, a top priority of the World Bank and the International Monetary Fund is to

A) focus on basic market foundations of guaranteeing property and contract rights. B) promote the increase of dead capital. C) make more loans. D) join forces and merge into one unit.

Refer to the figure above. If the price of a table is $2, what is John's income?

A) $20 B) $40 C) $60 D) $80

The people who support restricted international trade say that ______

A. protection saves jobs, in both the U.S. and foreign economies B. U.S. firms won't be able to compete with low-wage foreign labor if trade is free C. outsourcing sends jobs abroad, which brings diversification and makes our economy more stable D. protection is needed to enable U.S. firms to produce the things at which they have a comparative advantage

During a football game, it starts to rain and the temperature drops. The senior class, which runs the concession stand and is studying economics, raises the price of coffee from 50 cents to 75 cents a cup. They sell more than ever before. Which answer explains this?

A. The supply of coffee increased B. The demand curve for coffee was elastic C. The supply of coffee decreased D. The demand for coffee increased E. The demand curve for coffee was inelastic