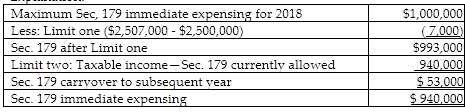

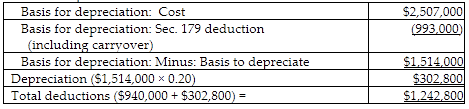

Sophie owns an unincorporated manufacturing business. In 2018, she purchases and places in service $2,507,000 of qualifying five-year equipment for use in her business. Her taxable income from the business before any Sec. 179 deduction is $940,000. Sophie elects to expense the maximum under Sec. 179 and does not apply bonus depreciation. What is Sophie's maximum total cost recovery deduction for

2018?

A) $940,000

B) $993,000

C) $1,242,800

D) $1,301,400

C) $1,242,800

MACRS depreciation:

You might also like to view...

As described by business ethicist Archie Carroll, an amoral manager ______.

a. deliberately tries to separate ethics and business operations b. does not understand ethics and often ignores ethical problems c. is deliberately unethical to employees and coworkers d. tries to encourage ethical behavior among employees but is not proactive about it

Wisconsin Farm Equipment Company sold equipment for cash. The income statement shows a loss on the sale of $7000. The net book value of the asset was $28,900. Which of the following statements describes the cash effect of the transaction?

A) positive cash flow of $35,900 from financing activities B) negative cash flow of $21,900 for operating activities C) negative cash flow of $21,900 for financing activities D) positive cash flow of $21,900 from investing activities

SMART goals are:

A) Specific, meaningful, achievable, relevant, and timely B) Specific, measurable, achievable, reachable, and timely C) Specific, measurable, attainable, relevant, and timely D) Specific, meaningful, attainable, reachable, and timely

The transaction doctrine that means "let the buyer beware" is ______________, and the transaction doctrine that means "let the buyer beware" is ________________

Fill in the blank(s) with correct word