Who bears the majority of a tax burden depends on whether the tax is placed on the buyers or the sellers

a. True

b. False

Indicate whether the statement is true or false

False

You might also like to view...

Suppose the demand for meals at a medium-priced restaurant is elastic. If the management of the restaurant is considering raising prices, it can expect a relatively:

A) large decrease in quantity demanded. B) large decrease in demand. C) small decrease in quantity demanded. D) small decrease in demand.

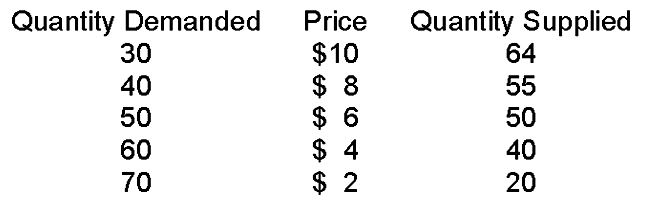

If the government set a price ceiling at $8

A. there would be a temporary surplus, then prices would fall to equilibrium.

B. there would be a permanent surplus, at least until the price floor was lifted.

C. the price would fall back to the equilibrium price.

D. the price floor would not have any effect on this market.

Consider two individuals — Howard and Mai — each of whom would like to wear sweaters and eat tasty food. The gains from trade between Howard and Mai are least obvious in which of the following cases?

a. Howard is very good at knitting sweaters and at cooking tasty food, but Mai's skills in both of these activities are very poor. b. Howard is very good at knitting sweaters and at cooking tasty food; Mai is very good at knitting sweaters, but she knows nothing about cooking tasty food. c. Howard's skills in knitting sweaters are fairly good, but his skills in cooking tasty food are fairly bad; Mai's skills in knitting sweaters are fairly bad, but her skills in cooking tasty food are fairly good. d. Howard's skills are such that he can produce only sweaters, and Mai's skills are such that she can produce only tasty food.

When the interest rate rises, people are:

A. more likely to borrow, that is, sell a financial asset. B. less likely to borrow, that is, purchase a financial asset. C. less likely to borrow, that is, sell a financial asset. D. more likely to borrow, that is, purchase a financial asset.