Suppose that the forward rate of Mexican pesos per dollar is selling flat, with both the spot and forward rates trading at 15 pesos per dollar

If the relevant interest rates for a foreign exchange speculator are 3 percent on dollars and 13 percent in pesos, a potential arbitrage operation would involve A) selling pesos in the forward market.

B) buying pesos in the forward market.

C) borrowing pesos now.

D) All of the above.

A

You might also like to view...

The Social Security Administration estimates that the Social Security Trust Fund will ________ and that the Medicare Trust Fund will ________

A) become fully funded by 2036; become fully funded by 2024 B) continue to get smaller as the number of retirees increases; start to grow once funds from Obamacare are funneled to the program C) grow slowly as more workers retire; decline slowly as medical costs rise D) run out of funds in about 20 years; run out of funds in about 10 years

If people leave bequests primarily because they are uncertain about the timing of their deaths,

A) the marginal propensity to consume out of a temporary change in income would tend to be higher than in the simple version of the LCH. B) unrealized capital gains from higher housing prices will probably lead to a higher consumption-to-income ratio than in the simple version of the LCH. C) increases in wealth from the stock market would be consumed over a longer time horizon than in the simple version of the LCH. D) A and C are both correct.

What are the definition and purpose of potential GDP?

What will be an ideal response?

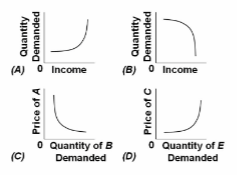

Refer to the diagrams. The case of complementary goods is represented by figure:

A. A.

B. B.

C. C.

D. D.