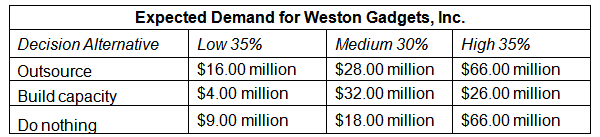

Refer to the data on Expected Demand for Weston Gadgets, Inc. For the various demand scenarios and their associated probabilities, the option to outsource has an expected value of ______.

a. $37.10 million

b. $31.65 million

c. $20.10 million

d. $17.85 million

a. $37.10 million

You might also like to view...

According to Festinger, which of the following factors is most relevant as people deal with the discomfort of cognitive dissonance?

A. Personal ethics B. Judgment of others C. Personality differences D. Control over the situation E. Experience with decision-making

Tina Robinson, Inc. (TRI) ? TRI management has decided to reinvent the culture of the organization. Previously, the company tried to make jobs more appealing by adding more responsibilities to each job description. However, this did not work. Next, the company decided to add flextime. It believed that this would make employees more dedicated. ? TRI then introduced even more work options for employees. For example, management decided to group all full-time employees into teams to allow employees with different backgrounds to learn from each other. Many different kinds of teams were allowed, as long as the group members did not interact via the Internet or any other electronic means. The managers reasoned that team members must work face to face to learn from and truly engage with each

other. ? Once these teams were formed, TRI management noticed that the quality of employees' work was much improved. The managers also observed that people felt much more comfortable with and tolerant of each other. Refer to Tina Robinson, Inc. Flextime is A. a system in which management sets the work hours for employees. B. a system in which employees set their own work hours with no limits. C. a system in which employees set their own work hours within employer-determined limits. D. working fewer hours than a standard work week. E. working more hours than a standard work week.

It is simpler to file a suit in a court of record than in an inferior court

Indicate whether the statement is true or false

A question of ethics

Between 1970 and 1981, Sanford Weill served as the chief executive officer (CEO) of Shearson Loeb Rhodes and several of its predecessor entities (collectively "Shearson"). In 1981, Weill sold his controlling interest in Shearson to the American Express Co, and between 1981 and 1985, he served as president of that firm. In 1985, Weill developed an interest in becoming CEO for BankAmerica and secured a commitment from Shearson to invest $1 billion in BankAmerica if he was successful in his negotiations with that firm. In early 1986, Weill met with BankAmerica directors several times, but these contacts were not disclosed publicly until February 20, 1986, when BankAmerica announced that Weill had sought to become its CEO but that BankAmerica was not interested in his offer. The day after the announcement, BankAmerica stock traded at prices higher than the prices at which it had traded during the five weeks preceding the announcement. Weill had discussed his efforts to become CEO of BankAmerica with his wife, who had discussed the information with her psychiatrist, Dr. Willis, prior to BankAmerica's public announcement of February 20. She had also told Dr. Willis about Shearson's decision to invest in BankAmerica if Weill succeeded in becoming its CEO. Willis disclosed to his broker this material, confidential information and purchased BankAmerica common stock. After BankAmerica's public announcement and the subsequent increase in the price of its stock, Willis sold his shares and realized a profit of approximately $27,500. The court held that Willis was liable for insider trading under the misappropriation theory.