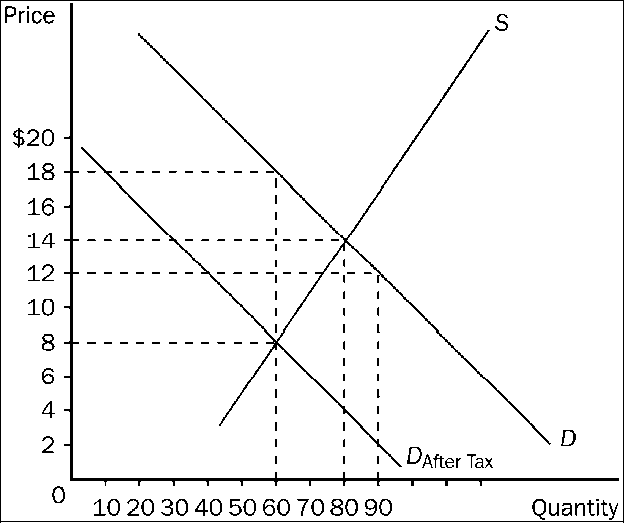

Figure 4-21

Refer to . The amount of the tax per unit is

a.

$10.

b.

$6.

c.

$4.

d.

$2.

a

You might also like to view...

Marginal cost can be defined as the change in

A. average total cost resulting from the production of an additional unit of output. B. total cost resulting from the production of an additional unit of output. C. average variable cost resulting from the production of an additional unit of output. D. total fixed cost resulting from the production of an additional unit of output.

Which of the following is true of an extensive-form game?

A) The sum of the payoffs to the players in the game is always constant. B) It involves simultaneous decision making by the players. C) It involves sequential decision making by the players. D) The players in the game earn equal payoffs in equilibrium.

Gelato ice cream maker shows the following on its balance sheet: revenue $200M, wages $100M, milk expenses $50M, strawberry purchases $5M, and taxes $25M. What is Gelato's contribution to GDP using the income approach?

A) $100M B) $125M C) $145M D) $200M

Recall the text's discussion of the ten largest U.S. industries by value added in 1860 and 1910 . The emergence of tobacco products and malt liquors as major industries by 1910 suggests that

a. these goods are highly income elastic. b. these goods are highly income inelastic. c. these goods are price inelastic. d. these goods exhibit economies of scale in production.