The interest rate on a bond is calculated as

A) the coupon times the face value.

B) the coupon divided by the face value.

C) the face value divided by the coupon plus the face value.

D) the face value divided by the coupon.

B

You might also like to view...

Approximately how long will it take Ethiopia to double its real GDP per person of $100 if its growth rate of real GDP per person is 0.9 percent?

A) 63 years B) 77.7 years C) 70 years D) 109 years E) 100 years

Unemployment compensation programs are called automatic stabilizers because payments increase during

A) expansionary periods. B) recessions. C) both recessions and expansions. D) wartime only.

What happens when the Fed aims to change interest rates?

A) It asks Congress to legislate new interest rates. B) It buys or sells government bonds on the open market to achieve the desired rate. C) It buys or sells dollars on the foreign exchange market to achieve the desired rate. D) It announces a new discount interest rate.

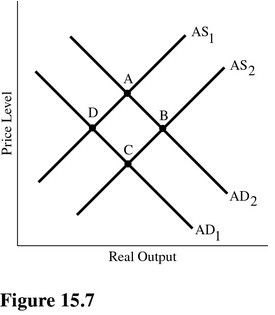

Refer to Figure 15.7. Suppose the money supply increases. This will cause interest rates to ________ and cause a shift from point ________.

Refer to Figure 15.7. Suppose the money supply increases. This will cause interest rates to ________ and cause a shift from point ________.

A. decrease; D to point C B. decrease; D to point A C. increase; A to point B D. increase; D to point A