If a firm or an industry is considered too big to fail, it is

A. unwise to regulate it because the regulation will slow growth.

B. wise to regulate it because of the moral hazard problem.

C. wise to regulate it because the regulation will make it smaller.

D. unwise to regulate it because it is too big.

Answer: B

You might also like to view...

Crowding out refers to a(n)

a. decrease in the amount of goods produced after too many goods have crowded onto the market b. business tactic used to steal a competitor's customers c. increase in one sector's spending caused by an increase in another sector's spending d. decrease in the price level after too many goods have crowded onto the market e. decline in one sector's spending caused by an increase in another sector's spending

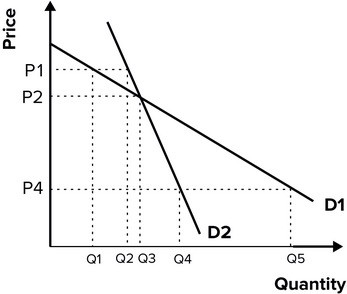

Refer to the graph shown. If a firm operating as if it were faced with a kinked demand curve believes that if it lowers price from P2 to P4, its rival will match the price cut, then:

A. D1 is the relevant demand curve. B. the demand curve used by the firm for decision making is highly elastic. C. it probably won't lower price, since the percentage decline in price will exceed the percentage increase in quantity sold. D. it probably will lower price, since doing so will increase sales.

You lend a friend $20,000 for a year at an annual interest rate of 5%. At the end of the year your friend must pay you ________ in interest.

A. $133 B. $750 C. $1,000 D. $1,900

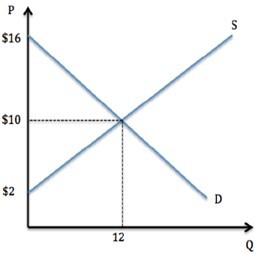

Assume the market was in equilibrium in the graph shown. If the market price gets set to $7, which of the following is true?

Assume the market was in equilibrium in the graph shown. If the market price gets set to $7, which of the following is true?

A. Some producers lose surplus, but total surplus rises. B. Some producers gain surplus, but total surplus falls. C. Some consumers lose surplus, but total surplus rises. D. Some consumers gain surplus, but total surplus falls.