How can the federal budget deficit affect the level of economic growth in the long run?

What will be an ideal response?

Two determinants of economic growth are the quantity and quality of physical capital. When the government borrows money to finance a deficit, interest rates rise while investment in physical capital decreases. This crowding-out effect results in less economic growth from the private sector.

You might also like to view...

When the government cuts the income tax rate, the supply of labor ________, the demand for labor ________, and the equilibrium level of employment ________

A) increases; increases; increases B) increases; decreases; increases C) increases; does not change; increases D) decreases; increases; increases E) increases; does not change; decreases

The group of economists who believed that the macroeconomy worked very well on its own were

a. microeconomists b. macroeconomists c. classical economists d. Keynesian economists e. Marxist economists

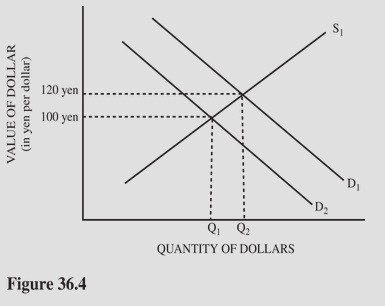

Refer to Figure 36.4 for the dollar-yen foreign exchange market. A decrease in demand from D1 to D2 could have been caused by

Refer to Figure 36.4 for the dollar-yen foreign exchange market. A decrease in demand from D1 to D2 could have been caused by

A. An increase in the number of Japanese visitors to the United States. B. A quota placed on Japanese television imports to the United States. C. A poor performance by the Japanese stock market compared to the U.S. stock market. D. A decrease in the demand for U.S. computers.

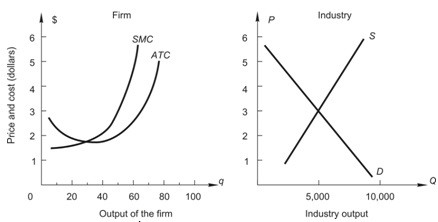

Below, the graph on the left shows the short-run cost curves for a firm in a perfectly competitive market, and the graph on the right shows the current market conditions in this industry. What do you expect to happen in the long-run?

A. Market supply will decrease. B. Market price will decrease. C. The firm's profit will decrease. D. both b and c E. all of the above