Which one of the following adjustments decreases net income for the period?

a. Recognition of depreciation on plant assets

b. Recognition of interest on a note receivable

c. Recognition of services that had been provided to customers but the cash has not yet been received

d. Recognition of rent as earned that had been received in advance from customers

a

You might also like to view...

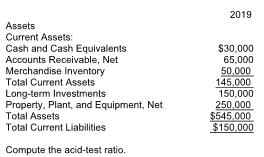

Extracts from the balance sheet of Detroit, Inc. are as follows:

Corporations issue preferred stock to raise capital without giving up control of the corporation and/or to boost the return earned by common shareholders.

Answer the following statement true (T) or false (F)

The goal of _______ in the context of business channels entails the augmenting products and services channel partners contribute to the supplier firm's market offering

a. market access b. value-added c. cost-to-serve d. total customer experience

A company's fixed interest expense is $8,000, its income before interest expense and income taxes is $32,000. Its net income is $9,600. The company's times interest earned ratio equals:

A. 4.0. B. 0.83. C. 0.25. D. 0.30. E. 3.33.