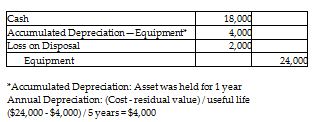

Equipment was purchased for $24,000 on January 1, 2018. The equipment's estimated useful life was five years, and its residual value was $4,000. The straight-line method of depreciation was used. Calculate the gain or loss on sale if the equipment is sold for $18,000 on December 31, 2018, the end of the accounting period. Prepare the journal entry to record the sale of equipment. Omit explanation.

What will be an ideal response?

You might also like to view...

The retained earnings statement is a required separate financial statement that discloses all changes in retained earnings during the accounting period

Indicate whether the statement is true or false

Preventative maintenance is an example of ______.

a. damage control b. preliminary control c. concurrent control d. rework control

If a previous claim letter has been refused or ignored, then a more persuasive approach using the ________ organizational pattern might be appropriate

Fill in the blank(s) with correct word

The elements that courts examine to determine undue influence include the following:

A) The will contains substantial benefit to the beneficiary. B) The beneficiary caused or assisted in the execution of the will. C) The will has an unnatural disposition of the testator's property. D) All of the above.