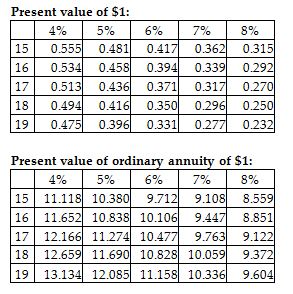

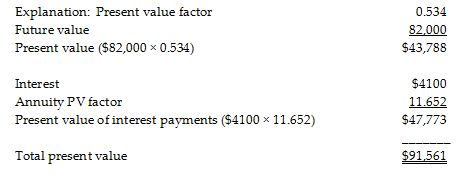

The face value is $82,000, the stated rate is 10%, and the term of the bond is eight years. The bond pays interest semiannually. At the time of issue, the market rate is 8%. What is the present value of the bond at the issue date?

A) $91,561

B) $47,773

C) $43,673

D) $84,788

A) $91,561

You might also like to view...

In constructing portfolios, investors are advised to consider intangible assets but ignore tangible assets

Indicate whether the statement is true or false.

The result when each stage in the supply chain makes its own separate forecast is often a match between supply and demand because these forecasts are often very different

Indicate whether the statement is true or false.

Why might someone choose to use itemized deductions instead of taking the standard deduction offered by the IRS?

A) It is easier to calculate your itemized deductions versus the standard deduction. B) You may have a lower tax liability if you itemize instead of using the standard deduction. C) Married taxpayers must use the itemized deductions only. D) Most computer tax software automatically itemizes deductions. E) both B and C are correct.

Benefits of warehouse management systems include each of the following except

A) increasing the bullwhip effect. B) managing receiving. C) decreasing the incidence of out-of-stocks. D) reducing inventory.