Revenue from gas wells that have been in production for at least 5 years tends to follow a decreasing geometric gradient. One particular rights holder received royalties of $4000 per year for years 1 through 6; however, beginning in year 7, income decreased by 15% per year each year through year 14. Calculate the future value in year 14 of the royalty income from the wells provided all of it was invested at 10% per year.

What will be an ideal response?

Find P in year 5, then find future worth of all cash flows

P 5 = 4000[1 – (0.85/1.10) 9 ]/(0.10 + 0.15)

= $14,428

F = [4000(F/A,10%,5) + P 5 ](F/P,10%,9)

= [4000(6.1051) +14,428](2.3579)

= [24,420 + 14,428](2.3579)

= $91,601

You might also like to view...

Answer the following statement(s) true (T) or false (F)

Brad nailers are used to fasten thin materials.

A radiator can be damaged by a collision with the cooling fan blade if a fan clutch or water pump bearing fails.

Answer the following statement true (T) or false (F)

A furnace with a vertical air flow through the heat exchanger and the blower compartment beneath the heat exchanger is called a(n) ____.

A. upflow B. downflow C. low boy D. horizontal

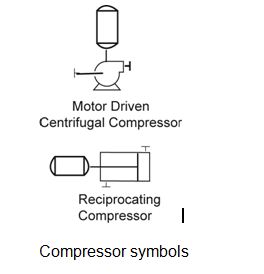

Draw the symbols for a blower and a reciprocating compressor.