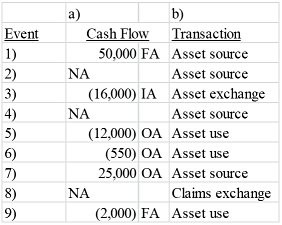

The following transactions apply to Einstein Corporation.1) Issued common stock for $50,000 cash.2) Provided services to customers for $28,000 on account.3) Purchased land for $16,000 cash.4) Purchased $1,500 of supplies on account.5) Paid $12,000 for operating expenses.6) Paid $550 on accounts payable.7) Collected $25,000 cash from customers.8) Accrued $600 of salary expense at year end.9) Paid $2,000 dividends to stockholders.Required:a) Identify the effect on the statement of cash flows for each of the above transactions. b) Classify the above accounting events into one of four types of transactions (asset source, asset use, asset exchange, claims exchange).

What will be an ideal response?

You might also like to view...

After 2017, a 37% excise tax applies to compensation in excess of $1 million paid to executives of tax-exempt organizations.

Answer the following statement true (T) or false (F)

A computer which is infected with malware and is added to a group's growing botnet is known as a zombie

Indicate whether the statement is true or false

Caring leadership is marked by two principal aspects, which are commitment to a task and concern for people.

Answer the following statement true (T) or false (F)

A college receives $ 500,000 of Pell Grants to be applied to current year student accounts for tuition and fees. What account should be credited upon receipt of the $ 500,000, assuming: The College is aprivate institutionThe College is apublic institutionA)Non-operating revenueNon-operating revenueB)Non-operating revenueLiability: Due to student accountsC)Liability: Due to student accountsNon-operating revenueD)Liability: Due to student accountsLiability: Due to student accounts

A. A) B. B) C. C) D. D)