The Paradox of Financial Innovation states that:

a. What once was thought of as a "financial innovation" is really just old wine in a new bottle (i.e., nothing new).

b.When a single firm, in isolation, tries to de-lever its balance sheet, the net effect is often for its leverage to rise.

c. Financial innovation is a puzzle (i.e., a paradox) and always will be.

d. When a large portion of the market tries to de-lever its balance sheet, asset prices fall, thereby causing leverage to increase (not decrease).

e. If not fully understood by users and regulators, financial instruments that were created to reduce risk can end up increasing them.

.E

You might also like to view...

If price discrimination occurs in a market

A) consumers whose demand for the product sold is more elastic pay higher prices than consumers whose demand is less elastic. B) the firm earns arbitrage profits. C) the marginal cost of production is constant. D) the law of one price does not hold.

A firm sells in a competitive market in which price is $12. Its marginal cost is 6 + 0.25Q. Determine the profit-maximizing level of output.

What will be an ideal response?

Skyline Chili wants to finance the purchase of new equipment for its restaurants. The firm has limited internal funds, so Skyline likely will

a. demand funds from the financial system by buying bonds. b. demand funds from the financial system by selling bonds. c. supply funds to the financial system by buying bonds. d. supply funds to the financial system by selling bonds.

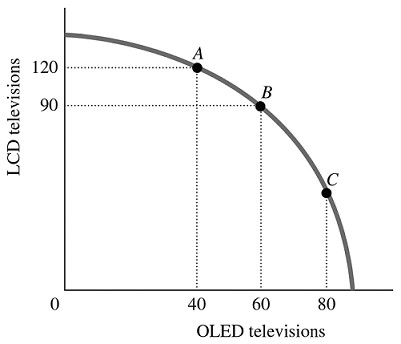

Refer to the information provided in Figure 2.5 below to answer the question(s) that follow. Figure 2.5Refer to Figure 2.5. For this economy to move from Point B to Point C so that an additional 20 OLED televisions could be produced, production of LCD televisions would have to be reduced by

Figure 2.5Refer to Figure 2.5. For this economy to move from Point B to Point C so that an additional 20 OLED televisions could be produced, production of LCD televisions would have to be reduced by

A. more than 30. B. exactly 60. C. fewer than 30. D. exactly 30.