The point at which the burden of a tax ultimately rests is known as the

a. effect of the tax.

b. impact of the tax.

c. incidence of the tax.

d. direction of the tax.

c. incidence of the tax.

You might also like to view...

In the economy of Talikastan in 2015, consumption was $3000, exports were $1200, GDP was $6300, government purchases were $1300, and investment was $1500 . What were Talikastan's imports in 2015?

a. -$500 b. -$700 c. $700 d. $500

The lure of _______ directs resources toward capital investments.

A. future profits B. current consumption C. high interest rates D. future interest rates

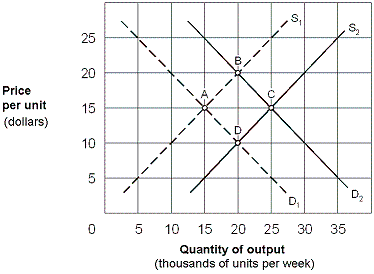

Exhibit 8-19 Long-run perfectly competitive industry

A. A to point B. B. B to point A. C. A to point D. D. A to point C.

Suppose an excise tax is imposed on product X. We expect this tax to:

A. increase the demand for complementary good Y and decrease the demand for substitute product Z. B. decrease the demand for complementary good Y and increase the demand for substitute product Z. C. increase the demands for both complementary good Y and substitute product Z. D. decrease the demands for both complementary good Y and substitute product Z.