Martha's mother Joan opened a trustee bank account. The designation on the bank account reads, "Joan Williams, as trustee for Martha Williams." This indicates that

A)

Joan will manage the funds in this account solely for the benefit of her daughter.

B)

Martha can presently retrieve funds from the account if she so wishes.

C)

Martha has no right to the funds in the account while her mother is alive.

D)

Martha has a right to retrieve funds from the account if her mother is mentally incapacitated.

C

You might also like to view...

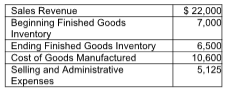

Prepare the income statement.

Citrine Manufacturing provided the following information for the month ended March 31:

What stores, views, and analyzes geographic data creating multidimensional charts or maps. For example, GIS are monitoring global warming by measuring the speed of glaciers melting in Canada, Greenland, and Antarctica?

A. Edge matching B. Cartography C. Automatic vehicle location D. Geographic information system

The horizontal boundaries imposed by work specialization and departmentalization are a part of an organization's external boundaries.

Answer the following statement true (T) or false (F)

Mrs. Fuente, who has a 37% marginal tax rate on ordinary income, is the sole shareholder and CEO of Furey Inc. She also holds a $1 million interest-bearing note issued by Furey. The corporation's current-year financial records show the following: Sales revenue$1,879,000 Mrs. Fuente's salary (160,000)Other operating expenses (414,000)Interest paid on Mrs. Fuente's note (60,000)Dividend distributed to Mrs. Fuente (100,000)Compute Mrs. Fuente's tax on her income from Furey. (Ignore payroll taxes in your calculations.)

A. $101,400 B. $91,200 C. $118,400 D. $64,000