What are the main factors that determine aggregate money demand?

What will be an ideal response?

The three main factors are interest rate, the price level and real national income. A rise in the interest rate causes individuals in the economy to reduce their demand for money. If the price level rises, individual households and firms will spend more money than before. When real national income (GNP) rises the demand for money will also rise.

You might also like to view...

There is a strong link between changes in the money supply and inflation

A) in neither the short run nor the long run. B) in the short run, but not in the long run. C) in the long run, but not in the short run. D) in both the short run and the long run.

M1 is comprised of currency held outside banks + traveler's checks + __________

A) credit cards B) savings deposits C) gold D) checkable deposits E) money market mutual funds

Which of the following macroeconomic variables is countercyclical?

A. Money growth B. Unemployment C. Real interest rates D. Consumption

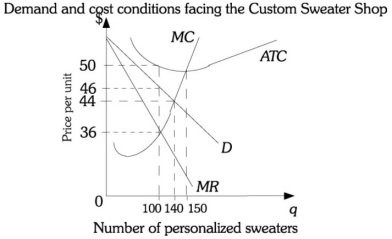

Refer to the information provided in Figure 15.5 below to answer the question(s) that follow.  Figure 15.5 Refer to Figure 15.5. Assume The Custom Sweater Shop has fixed costs of $500 and is a monopolistically competitive firm. At the profit-maximizing output in the short run, the firm ________ of $46.

Figure 15.5 Refer to Figure 15.5. Assume The Custom Sweater Shop has fixed costs of $500 and is a monopolistically competitive firm. At the profit-maximizing output in the short run, the firm ________ of $46.

A. earns a profit B. has an average total cost C. should set a price D. has an average variable cost