What are the unconventional policy options that central bankers can use if the traditional target interest rate hits the lower bound?

What will be an ideal response?

The central bank can use forward guidance to diminish expectations for future policy rates; quantitative easing to expand its balance sheet; and targeted asset purchases to influence relative asset prices (especially in dysfunctional markets) and stimulate expenditures.

You might also like to view...

Steve holds 100 shares of a company that currently trade at $10 . There is a 50 percent probability of the market price increasing to $15 within the next quarter. If Steve waits for the market price of shares to increase before selling them off, he would be considered risk averse

Indicate whether the statement is true or false

In the United States, MSW generation

a. has been stable for the past several decades b. growth over time has not been met with improved waste management practices c. has sharply declined over time d. per capita shows a continual decrease since 1980

An increase in which of the following will increase the value of the spending multiplier?

A) The supply of money B) Equilibrium output C) Personal income tax rates D) The marginal propensity to consume E) The required reserve ratio

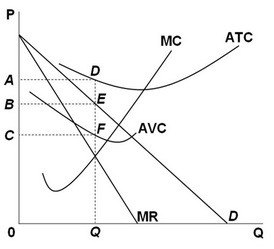

Refer to the above graph. Consider a monopolist in short-run equilibrium. This monopolist has total fixed cost equal to area:

Refer to the above graph. Consider a monopolist in short-run equilibrium. This monopolist has total fixed cost equal to area:

A. ABED. B. ADFC. C. 0CFQ. D. BEFC.