Corporations are able to raise large amounts of financial capital because

A. of limited liability and the treatment of a corporation as an individual entity.

B. of their greater ability to monitor the performance of decision makers.

C. of the tax breaks corporations are given relative to partnerships or proprietorships.

D. of the elimination of the problem of separation of ownership and control.

Answer: A

You might also like to view...

Suppose the marginal tax rate is 37 percent for an income level of $50,000 and 39 percent for an $80,000 income. This implies that the underlying tax structure is _____ in nature

a. fixed b. progressive c. regressive d. lump-sum e. proportional

A patent

a. is given only to government owned companies. b. is not a legal impediment to entry. c. is a privilege granted by a state to an inventor over his invention. d. does not give the holder a monopoly during the period it is in effect.

Under the gold standard system, if the par exchange rate is $1 = 2 pounds, but the market exchange rate in the United Kingdom is $1 = 1 pound, then a person interested in arbitrage would:

A) buy dollars in the United Kingdom to be shipped to the United States and exchanged for a larger quantity of gold. B) find that it is not possible to engage in arbitrage. C) convert dollars into pounds in the United States and sell it for gold in the United Kingdom. D) lose money by trying to exploit any price difference.

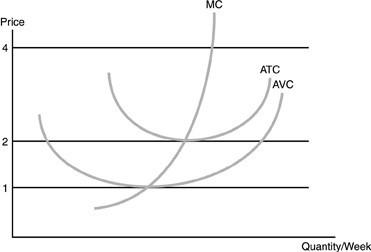

Refer to the above figure. Profits will be positive

Refer to the above figure. Profits will be positive

A. when the price equals $1. B. at prices between $1 and $2. C. when the price is above $2. D. when the price equals $2.