In 2019, Gregory receives a reimbursement for last year's medical expenses of $1,200. As a result, Gregory must

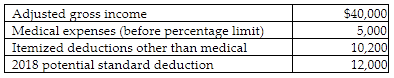

A review of the 2018 tax file of Gregory, a single taxpayer who is age 40, provides the following information regarding Gregory's 2018 tax status:

A) include $200 in gross income for 2019.

B) include $1,200 in gross income for 2018.

C) reduce 2018's medical expenses by $1,200.

D) amend the 2018 return.

A) include $200 in gross income for 2019.

Include in 2018's income the lesser of the reimbursement or to the extent the tax benefit received in 2018.

You might also like to view...

If all sales were made for cash, it would not be necessary to adjust the sales reported on the income statement

a. True b. False Indicate whether the statement is true or false

The modular approach is also referred to as the phased approach

Indicate whether the statement is true or false

When you present your speech with an extemporaneous style, your presentation is

A) read word-for-word B) off-the-cuff C) prepared and well-rehearsed D) memorized

A company's cost of goods sold was $15,500 and its average merchandise inventory was $4,500. Its inventory turnover equals 3.4.

Answer the following statement true (T) or false (F)