If the taxes by state and local governments were combined with the Federal tax system, the overall tax structure in the U.S. would best be characterized as:

A. Progressive

B. Highly regressive

C. Slightly regressive

D. Proportional

A. Progressive

You might also like to view...

Refer to the above figure. At a price of $2 per gallon, the quantity demanded of gasoline is

A) 80,000 gallons per month. B) 100,000 gallons per month. C) 60,000 gallons per month. D) 140,000 gallons per month.

If we observe an increase in real GDP and an increase in the price level after an increase in aggregate demand, we can conclude that

A) the aggregate supply curve is upward sloping. B) the aggregate supply curve is horizontal. C) the aggregate supply curve is vertical. D) the economy is now at full employment.

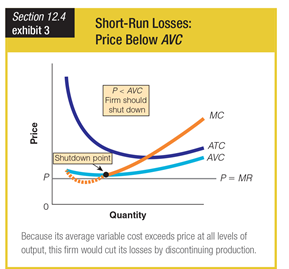

Based on this graph, which of the following is the best reason for the firm to shut down?

a. The AVC curve is completely above P.

b. The ATC curve is completely above P.

c. The MC curve is mostly above P.

d. The MR curve is equal to P.

Marginal utility is

A. the change in total utility from consuming an additional unit of a good. B. the utility received by the last consumer of a good. C. the total utility received from consuming a given quantity of a good divided by the number of units consumed. D. the utility received from consuming the first unit of a good.