Find the tax in the following application problems. Use $4050 for each personal deduction, a standard deduction of $6300 for single taxpayers, $12,600 for married taxpayers filing jointly, $6300 formarried taxpayers filing separately, and $9300 for head of household and the tax rate schedule. Megan Cortez had an adjusted gross income of $55,704 last year. She had deductions of $939 for state income tax, $764 for property tax, $3,890 in mortgage interest, and $1,294 in contributions. Cortez claims one exemption and files as a single person.

Megan Cortez had an adjusted gross income of $55,704 last year. She had deductions of $939 for state income tax, $764 for property tax, $3,890 in mortgage interest, and $1,294 in contributions. Cortez claims one exemption and files as a single person.

A. $8,329.25

B. $10,051.00

C. $7,676.00

D. $6,963.00

Answer: D

Mathematics

You might also like to view...

Solve by isolating the absolute value and using the absolute value property.|5k + 2| + 3 = 9

A.

B.

C.

D. ?

Mathematics

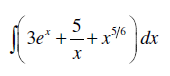

Evaluate the following:

1. ? dx

2.

3.

Mathematics

Solve the problem.The speed of a vehicle is inversely proportional to the time it takes to travel a fixed distance. If a vehicle travels a fixed distance at 25 miles per hour in 30 minutes, how fast must it travel to cover the same distance in 15 minutes?

A. 18 mph

B.  mph

mph

C.  mph

mph

D. 50 mph

Mathematics

Provide an appropriate response.The following proportion is not true. Change any one of the numbers in the proportion to make it true.

What will be an ideal response?

Mathematics