Answer the following questions true (T) or false (F)

1. One effect of adverse selection in a market is that the equilibrium quantity of the product may

be smaller than it would have been if there were no asymmetric information problems.

2. Due to adverse selection, very few lemons will be sold in the market for used cars.

3. The situation in which one party to a transaction takes advantage of knowing more than the other party to the transaction is known as asymmetric information.

1. TRUE

2. FALSE

3. FALSE

You might also like to view...

Suppose a coupon bond with a par value of $1000 is currently priced at $950 and has a coupon of $40. Which of the following is true?

A) current yield > coupon rate B) current yield < coupon rate C) coupon rate has risen D) coupon rate has declined

The foreign exchange system that has the highest foreign exchange risk is

A) the dirty floating exchange rate. B) the fixed exchange rate. C) the floating exchange rate. D) the Bretton Woods system.

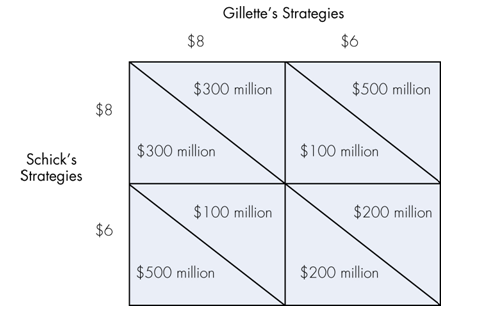

Refer to the table below for an oligopolist’s dilemma. Gillette and Schick are two companies competing in the same oligopoly market. The profit payoff for Gillette is shown in the upper corner of each box, and the profit payoff for Schick is shown in the lower corner of each box. If they cooperate and undertake price collusion the most likely price charged by each firm will be

a. $8 charged by both companies.

b. $6 charged by both companies.

c. $8 charged by Gillette and $6 charged by Schick.

d. $8 charged by Schick and $6 charged by Gillette .

Who is affected by externalities? Those receiving external benefits differ from those incurring external costs in that external benefits are associated with

a. government intervention b. market failure c. unclear property rights d. third parties e. free riders