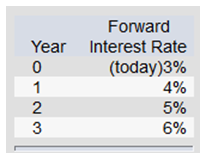

If you have just purchased a 4-year zero-coupon bond, what would be the expected rate of return on your investment in the first year if the implied forward rates stay the same? (Par value of the bond = $1,000.) Suppose that all investors expect that interest rates for the 4 years will be as follows:

A. 5%

B. 3%

C. 9%

D. 10%

E. None of the options are correct.

B. 3%

The forward interest rate given for the first year of the investment is given as 3% (see table above).

You might also like to view...

Many consumers are willing to pay $100 for a perfume that contains $10 worth of scent because the perfume is from a well-known brand. What kind of a pricing is the company depending on?

A) going-rate pricing B) image pricing C) market-skimming pricing D) target pricing E) markup pricing

In U.S. GAAP, preferred stock subject to redemption at the option of the preferred shareholders appears

a. between liabilities and shareholders' equity. b. as a liability. c. as a shareholders' equity. d. as a revenue. e. as an expense.

Product liability cases and strict product liability cases would all be considered ____________________ torts.

Fill in the blank(s) with the appropriate word(s).

What is one of the benefits of industry classification systems like NAICS?

A. They are the only type of data needed for industry segmentation. B. They can be applied to the whole world no matter which system is used. C. They make it easy for business marketers to identify potential customers. D. They allow for the classification of industries without any repetition. E. They provide a consistent means of categorizing industries.