Greg, a 40 percent partner in GSS Partnership, contributed land to the partnership in exchange for his partnership interest when the partnership was formed. At the time, his basis in the land was $30,000 and its FMV was $133,000. Three years after the partnership was formed, GSS Partnership decided to sell the land to an unrelated party for $150,000. When the land is sold, how much of the gain should be allocated to each partner of GSS Partnership if Sam and Steve are each 30 percent partners?

What will be an ideal response?

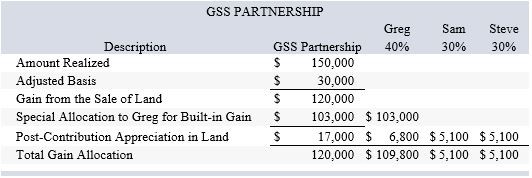

The $103,000 built-in gain on the land at the time it was contributed must be specially allocated to Greg, the contributing partner. Any remaining gain should be allocated to the partners according to their profit-sharing ratios. The table below reflects the required allocations:

You might also like to view...

Which of the following is a set price or price range in consumers' minds that they refer to in evaluating a product's price?

A) dynamic price B) internal reference price C) suggested retail price D) captive price E) value price

Explain how a firm might use a special purpose entity (SPE) to subvert the standard-setting process.

What will be an ideal response?

Which location type is generally characterized by no competition, good road visibility, and easy parking?

a. isolated store b. business district c. strip d. shopping center

Which of the following is true of an illegal consideration?

A) Contract requires that either both parties suffer legal detriment. B) Contract requires that the promisor receives a legal benefit. C) Contract requires that the promisee suffer a legal detriment. D) Contracts based on illegal consideration are void.