Rita, who has a marginal tax rate of 37%, is planning to make a gift to her grandson who is in the lowest tax bracket. Which of the following holdings of stock would be the most tax advantageous gift from Rita's perspective?

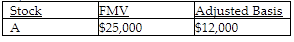

A)

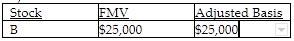

B)

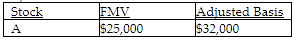

C)

D) For income tax purposes, Rita will be indifferent as to choice of stock to gift.

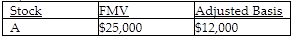

A)

Gifts of appreciated property are generally advantageous because the gain recognition will be shifted to the donee who will pay tax at a lower rate (or at 0%).

You might also like to view...

_____ is the proportion of time that the ASP's systems and communication links are up and running.

Fill in the blank(s) with the appropriate word(s).

The authority to punish is known as which type of power?

A. reward B. coercive C. expert D. referent

Nick and Jamie own stock in Chromex Industries, a watch manufacturer. In 2015, Nick received dividend at the rate of 2 percent, whereas Jamie received dividend at the rate of 0.5 percent. In this scenario, which type of stock did Nick own?

A) cumulative preferred B) common C) convertible D) participating preferred

Bodie's application to City Bank for a credit card is denied. Bodie can obtain information on her credit history in a credit agency's files under

A. no federal law. B. the Equal Credit Opportunity Act. C. the Fair Credit Reporting Act. D. the Fair Debt Collection Practices Act.